Trump Tariffs Will Help Big Business, Hurt Small. Here's How

[Opinion] Big businesses have the heft and reach to switch up their supply chains. Mom-and-pop shops will be the pawns in this game of geopolitical chicken

Good Evening from Taipei,

Incoming president Donald Trump made a surprise announcement this week. Its impact on global supply chains and US business deserves a close look.

We all knew that China was in Trump’s sights with constant promises to raise tariffs on the world’s second-largest economy. On the campaign trail he pledged to slap a 60% import tax on goods coming from China and 10% on the rest of the world.

But on Monday he vowed to charge 25% on products from neighbors Mexico and Canada the moment he steps into office, while China would cop an “additional 10% Tariff, above any additional Tariffs, on all of their many products.”

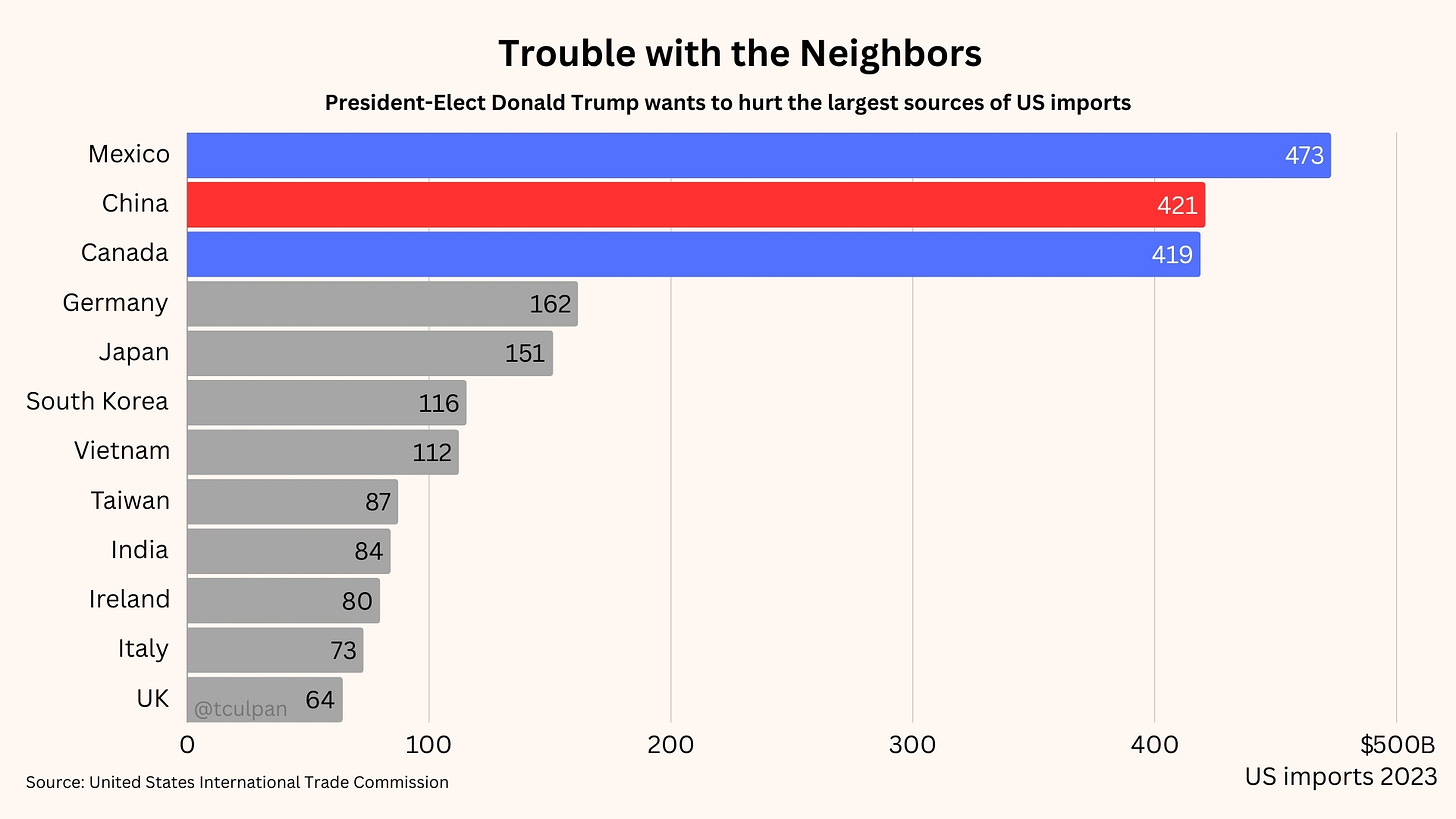

That’s a big move because Mexico, not China, is the large source of US imports and Canada is in third place by only a fraction.

Three weeks ago Donald Trump was running for president, and no one ever holds candidates to account for election promises. Now that he’s President-elect we need to take him seriously, if not literally.

Many people missed the context of Trump’s big announcement, which he tied to the ongoing fentanyl crisis in the US and supposed influx of illegal immigrants. “This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country,” he posted on social media.

Both issues resonated heavily during the campaign and were crucial to his win. However, that clause is dangerous for supply chains because it gives Trump the option to cancel such tariffs if he feels Ottawa and Mexico City are taking him seriously. Manufacturers and buyers can’t make smart and optimal long-term production and procurement decisions based on the whims of one man.

I have some sympathy for the new President and the people who elected him. Drugs are a massive problem and millions of Americans feel they were left behind while coastal elites got rich. Blaming outsiders is a tradition not exclusive to the US. Somebody needs to do something, and US voters felt that this somebody should be Donald Trump.

But it’s crucial that we understand that his sudden policy move will be brutal for the thousands of supply chain, procurement, manufacturing, and logistics firms who must handle two crises in one. Worse, it’ll hurt smaller businesses because they are less able to adapt to these shifting whims.

Here’s what I mean.

Crisis One will be the rush to get products over the border before the tariffs kick in. Customers may push factories to ramp up production in the eight weeks before the Executive Order comes down. But really this is a logistics headache which will ruin Thanksgiving and Christmas for numerous American businesses big and small, while ramping up the pressure on factories abroad.

Crisis Two is bigger. It’s one which will likely push many US companies to the wall. That’s because of the butterfly effect which tariffs have on entire supply chains.

To understand the impact let’s look at some historical examples of tariff policy.

Tariffs Can Work

As much as I hate to admit it, import taxes worked for Indian Prime Minister Narendra Modi a decade ago. But that’s only because the world’s most-populous country possessed two important traits: abundant low-cost labor, and a massive untapped, fast-growing consumer market.

Modi’s tariff hikes solidified for global brands and their manufacturing partners the urgency of doing quickly what would probably have taken years — reduce reliance on China. And we should remember why companies wanted to do this. Not only because of the trade war (which Trump escalated in his first term) but because many of the qualities which China once had were evaporating. Labor was no longer cheap nor plentiful, its domestic market was slowing, and nationalism, government policy and local preferences were squeezing out foreign players.

It was somewhat inevitable that buyers and factory owners would look elsewhere, so Modi’s tariffs were perfectly timed to ensure that decision makers in far-off lands embraced his “Make in India” program.

Import Substitution Preserves Forex

For another case study, we go back 70 years. Taiwan’s fresh-off-the-boat Republic of China government enacted stiff tariffs for a different reason. Having fled to the island while still fearful of the Communists, its foreign exchange reserves were rapidly depleting. The Kuomintang under Chiang Kai-shek needed to stop spending hard currency on inconsequential items like food, textiles, clothing and household items. That money was needed to buy weapons.

Tariffs were a catalyst for Taiwan’s successful shift to import substitution, but only because they were coupled with plenty of cheap and frugal labor (employees worked hard but didn’t spend much on luxuries), as well as buckets of foreign aid in the form of cash and equipment. Taiwan also had a long-term plan which centered around being a small export-driven economy.

The US of 2024 is not India circa 2014 nor the Taiwan of 1954. Its labor isn’t cheap, it doesn’t have an untapped and growing middle class, and it lacks an overseas market multiples its size. While the US is still the world’s largest economy, most private consumption goes towards services rather than goods at a ratio of 2:1 — and those services are largely procured domestically.

Throwing up tariffs, especially as a negotiating tactic rather than as an anchor for long-term economic policy, risks triggering Crisis Two: dislocated supply chains and perpetual uncertainty, which will lead to company closures.

Big firms like Apple, General Motors, Pottery Barn, and Walmart can quickly adapt because they have suppliers spread around the world. What’s more, because of the size of these massive buyers, suppliers will always prioritize their whales over the little fish. Faced with a supply crunch, household names like Nike, Stanley Black & Decker, Unilever, or P&G would be naturally inclined to keep their big buyers happy — that means retailers like Amazon, Walmart, Costco, and Kroger. Small stores will lose.

While the stronger companies can switch from Mexico to Vietnam or Canada to the US because they have access to the largest manufacturers who have multiple locations around the world, little firms will suffer.

A family-run factory which makes bathroom furnishings or a custom motorbike builder who has a long-term relationship with a metal shop across the border will struggle to find a new supplier in Vietnam, or a reliable and competitive local alternative. They’ll eat the tariffs and be rendered more expensive — or unprofitable — while the big nationwide firm which always loomed large will suddenly have more supply at better prices.

For a look at the massive upheaval underway in the global tech industry and their crucial supply chains, I recommend you read Hon Hai Tech Day & The Future of the Global Economy

With a long-term strategy and all the economic winds in its favor, these problems can be overcome. That custom motorbike builder can train a new metal shop across the country and the family-run factory could hook up with a newly established supplier two towns over. These things require time, they require labor, and they require money.

Most importantly the upside of tariffs — as seen in India and Taiwan — requires policy stability. Supply chains take time to build and they don’t shift easily. When they do, companies need to be sure that their new factory has long-term potential and won’t be used as some bargaining chip in a game of geopolitical chicken. If this certainty is missing, then so too will be the jobs Trump hopes to create.

Over the next year you will surely read stories of companies opening factories and expanding their US workforce in an embrace of domestic production. But you won’t hear the thousands of stories of small local manufacturers and mom-and-pop shops forced under because they lack the ability to nimbly shift from one low-cost country to another while awaiting the end of a whimsical and unstable industrial policy.

Sure, import tariffs can work. But they needed to be wielded carefully like a surgeon’s knife, not swung like a cudgel against foes real and imagined.

Thanks for reading.

Similar Items on This Topic:

Would you expect a billionaire to care about the fortunes of small businesses? Would you expect a psychopat to care about the fate of ordinary people?