TSMC Earnings Show AI Is Lifting All Boats

[Opinion] Full-year earnings and outlook show how important AI is for all sectors of tech.

Good Evening from Taipei,

I have an important scoop coming in the next few hours. But first, I want to talk about TSMC earnings and outlook following its 2024 full-year investor conference Thursday afternoon.

TSMC Earnings and Outlook

In addition to the past (earnings), TSMC spoke about the future (outlook). Management is quite formulaic in how it presents all this information, which makes covering it quite a delight: there’s a reason why its IR team garners accolades.

To save wordage, and your time, relevant slides on earnings and 1Q outlook are here. The longer-term outlook is always given verbally, which I summarize as well.

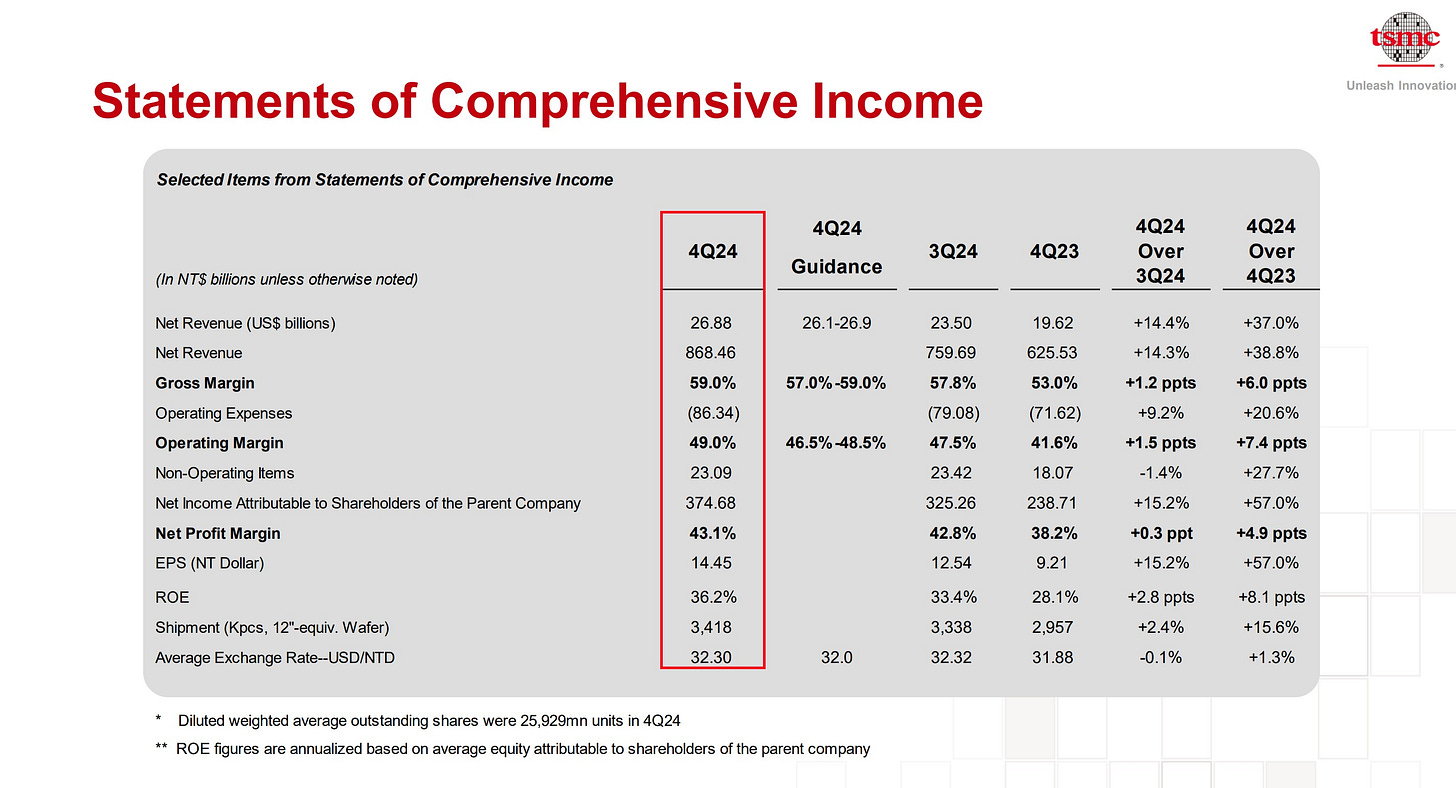

Earnings were solid, but not surprising

Big Jump in Latest Node, Which is Normal Since it’s iPhone Season

This Blew My Mind and Solidifies the Importance of AI. Smartphone Isn’t Weak, Though.

Solid, But Not Crazy Outlook

Other Items:

Foundry 2.0 Industry to grow 10% this year

Inventory Turnover in 4Q: 80 days (lowest in 4 years)

Full-year 2025 Revenue Growth Outlook: ~25% (in USD terms)

TSMC Forward Average Revenue Growth: ~20% from 2024

Revenue from AI Accelerators: average 45% over the five years from 2024

Long-term Gross Margin Target: 53%+ (reiterating previous target)

Gross-Margin Drag from Overseas Fabs: Cuts GM by 2-3% (reiterating)

Advanced Packaging was 8% of Revenue in 2024, will be ~10% in 2025.

Big news: A massive 30% increase to $38 billion to $40 billion! (from $29.7b)

The nature of TSMC’s business model means that its quarter-ahead outlook is pretty bulletproof. After all, it has already booked that capacity and agreed on price. Things which may cause final results to deviate from forecast include exchange rates, natural disasters, and troubles with execution. The latter is not unheard of, but is rare and usually known long before such issues interrupt the short-term forecast.

TSMC’s full-year outlook, both for itself and the industry is far more crystal-ball gazing, however. The technology hardware business moves quickly, and the chip sector is particularly prone to sharp changes in demand. Still, TSMC tends to be conservative with its company-specific and industry-wide outlooks.

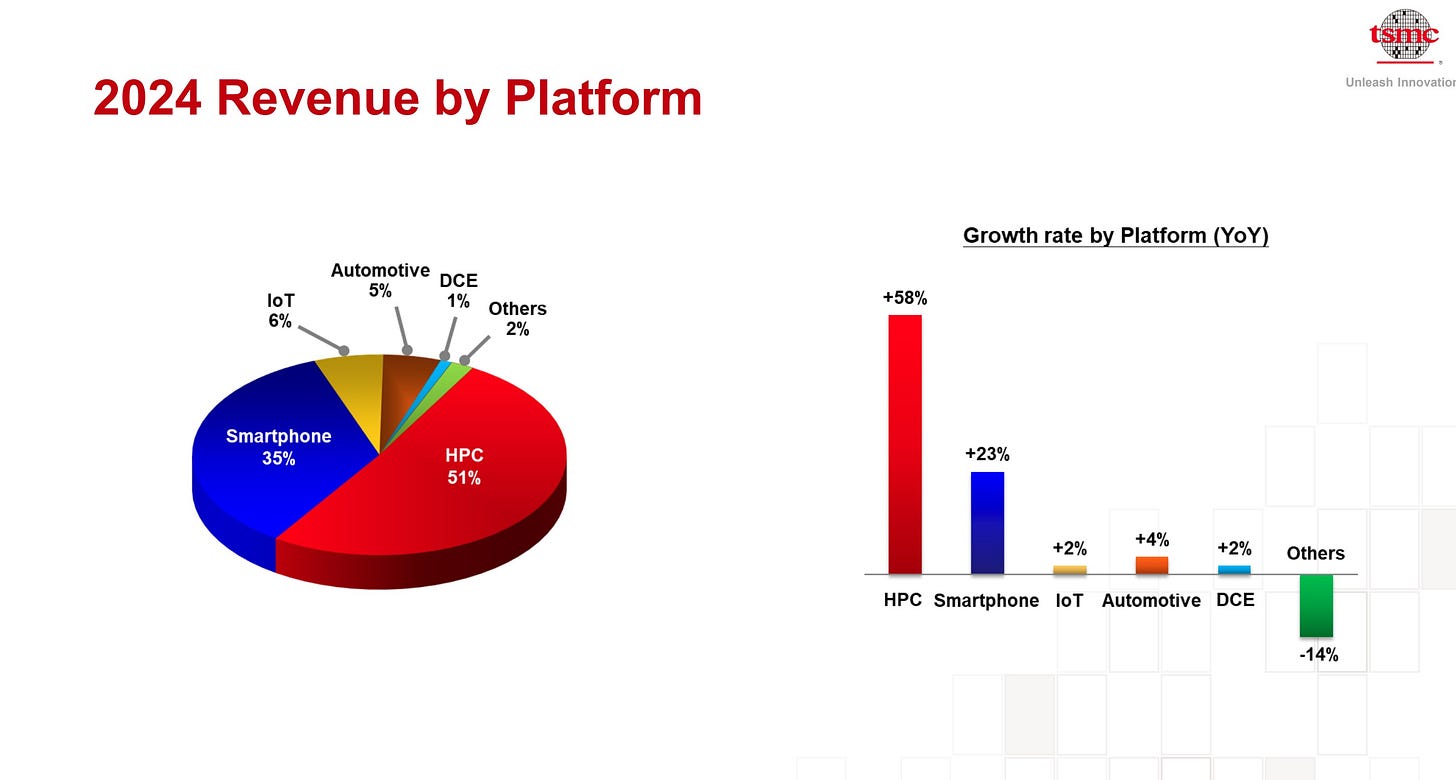

AI Everywhere, All at Once

With all the hype about generative AI, it’s easy to forget that the backbone of TSMC’s business for much of the past two decades has been mobile. Even apart from its exclusive contract to make Apple’s A-series processors, TSMC dominates the smartphone System-on-Chip market with clients such as Qualcomm and Mediatek. The need for leading-edge manufacturing comes down to the never-ending quest to add more grunt to smartphones while minimizing size and battery drain. Related chips, like modems, also count towards this category.

TSMC started to rely more heavily on high-performance computing (HPC) only in recent years. Before AI training and inferencing chips from Nvidia and AMD were included, this category could broadly be labeled as chips which help run servers and data centers. Various Intel and AMD processors are in this group, as are Nvidia’s graphics chips (before they became AI processors), as well as those which help store and stream video and audio. Plus Bitcoin mining. This latter category has been a huge buyer of leading-edge capacity because Bitcoin-mining is an arms race fought with weapons made of silicon.

HPC overtook Smartphones as TSMC’s top revenue source in 2022 and hit 51% of revenue last year. It’ll likely stay that way for a few years.

TSMC has been the beneficiary of a daisy-chain of epochal events, each boosting sales when the prior started to fade: the smartphone boom, Covid-driven Work-From-Home, and now generative AI. It’s not just luck. In fact, many of these developments were possible only because TSMC exists in the form it does.

What’s interesting is that, according to CEO CC Wei, smartphones will also get a big boost from AI. Here’s how he explains it:

Smartphone unit growth will be low-single-digit percent. But:

AI functionality will be added to smartphones: more chips needed

Leading technology becomes more important: more leading-edge needed

Shorter smartphone replacement cycle: buy more often

The key takeaway here is that AI is now lifting all boats, and not just those in the large-scale data-center arena. Sure, Nvidia and AMD are the flag bearers of this new era of growth, but SoC makers like Apple, Qualcomm, and Mediatek will definitely be players.

Thanks for reading.

A correction to last week’s piece on TSMC Arizona. The codename for the AMD Ryzen chip is Eldora, not Grand Rapids. The mistake was entirely mine. Apologies.