Apple Set to Scrap Parts for Up to 1.5 Million Units of iPhone Air

[Exclusive] Inventory write-offs may hit 1.5 million units across the supply chain, but the risk may still be worth it.

Good Evening from Taipei,

Apple and its suppliers are currently tallying up the cost of severely miscalculating consumer enthusiasm for last year’s iPhone Air. Weighing 12 grams less but with a slightly larger screen than the iPhone 17, Apple made the bet that customers would be willing to pay $200 more for, well, “air.”

They were wrong, with Nikkei’s Lauly Li and Chen Ting-fang reporting as early as October that suppliers had been told to reduce output of the Air in favour of other models. Kuo Ming-chi, the Apple Whisperer, followed up a day later by noting that iPhone Air sales had fallen short of expectations.

Exactly how short has been hard to quantify, until now.

Apple and its suppliers are now stuck with components for up to 1.5 million units of iPhone Air, my sources tell me, even after the order came down in October to cut back production. What’s worse, some of that cannot be repurposed and instead may need to be scrapped, I am told. To be clear, that doesn’t mean 1.5 million iPhones will be scrapped, merely some of the components specific to the iPhone Air.

Culpium is an independent media outlet. Media are requested to cite Culpium, with a link. Thanks.

Apple will release earnings this week, but it’s unlikely Tim Cook and his team will discuss the issue. Apple’s CEO dodged the question of Air’s poor sales last quarter, and instead chose to talk up the iPhone 17 Pro and iPhone 17 — a tacit admission that Air was a dud.

My own analysis, based on what cannot be re-used, puts the write-off into the low hundreds of millions of dollars. Frankly, that’s not a big deal: iPhone sales were $49 billion in the three months to Sept. 27, and are expected to be around $80 billion for the December quarter.

The bigger issue is how Apple failed to understand its own customers, and how this mess will ripple through the supply chain. I am told that while some vendors will be stuck with a bill, Apple itself will soak up most of the cost.

BOM Analysis

There are three main categories of components that cannot be repurposed for other models, and they just so happen to be among the most expensive items on the bill of materials (BOM).

The titanium frame is specific to the iPhone Air in both size and materials, with the other two models using aluminium. Excess inventory here cannot be repurposed but can be recycled. In fact, 80% of this inventory is already recycled, so Apple and its suppliers will recoup some of the cost.

The OLED “Super Retina XDR” screen is basically the same across all models, but the Air’s 6.5-inch size is mid-way between the 6.9-inch and 6.3-inch versions. I am told that displays which have already been cut, framed and put onto modules will need to be scrapped, though some of that will also be crushed, separated, and recycled.

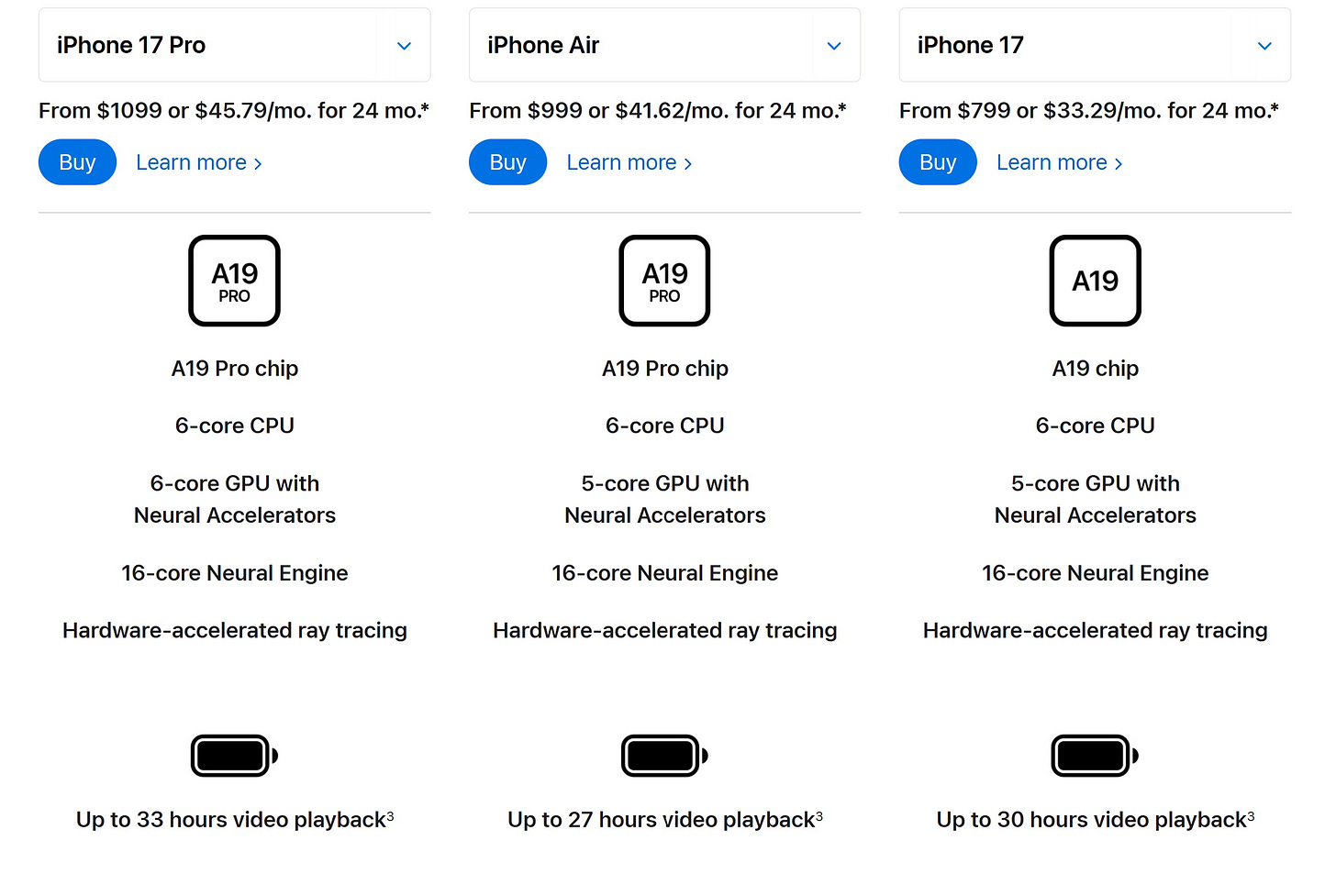

Possibly the biggest hurt could be with the chips. Apple uses the same A19 Pro CPU in the Air as it does with the iPhone 17 Pro. But the Air has only 5 GPU cores — as does the base iPhone 17 — while the iPhone 17 Pro has 6 GPU cores. (To be blunt, this is merely chip binning, not a new chip).

As a result, the unused Air chips cannot be put in the the lower-end base iPhone 17 nor in the higher-end iPhone 17 Pro. They cannot be repurposed. Even worse, the Air has 12GB of DRAM while the baseline iPhone 17 has just 8GB, according to TrendForce. So, any processor modules which have already had their DRAM fused onto the CPU would also result in wasted DRAM — unless Apple and TSMC find some magical way to “unfuse” the memory from the base die.

Such an error is particularly painful when you consider that at least some of the TSMC capacity dedicated to these wasted chips could have been put to something more fruitful, not to mention the current shortage and high prices of DRAM.

Apple didn’t understand its own market, but it was also stuck in a bind. The bill of materials on the Air was quite high owing to the unique specs, such as the custom titanium casing. It attempted to ameliorate this cost by de-speccing the Air even with respect to the cheaper version — notably with one less camera. But that wasn’t enough, and in the end the Air had a worse gross margin than most of Apple’s lineup despite being $200 more expensive than the cheapest iPhone.

Apple’s Innovation Dilemma

Yet Apple did not make a mistake. This strategy was entirely correct. Apple tried to innovate by developing a product it hoped at least some consumers would appreciate, and then attempted to price it at a level they’d accept while allowing the company to make a decent profit. If Apple only played it safe and developed boring products which it already knew consumers wanted, then it might as well just produce Marvel movies.

It was also not wrong to overbuild. When gross margins are high and consumer patience wears thin, it can be more costly to lose out on a sale than to scrap some of the materials that go into the device. Apple, like any physical products company, likely did a best and worst case analysis, calculated the BOM cost and weighed it against the opportunity cost of each scenario and set production targets accordingly. This is economically rational, but only where the cost is largely variable — such as materials — rather than fast-depreciating fixed assets, likely semiconductor equipment. Any non-manufacturing physical-products company is right to err on the side of inventory over empty shelves.

Everyone’s Problem

The bigger lesson here is Apple’s structural challenge, and one which the entire industry is learning. There was a time when all iPhones came from one company in one location — Foxconn in Shenzhen. This made logistics and inventory management pretty easy. The world has changed. The US-China trade war, rising labor costs in China, and growing concern over putting too much economic power in Beijing’s hands have spurred both clients and suppliers to manufacture elsewhere. After dragging its feet, Apple is finally catching up.

The latest iPhone was assembled by three companies — Foxconn, Luxshare-ICT and Tata — in two countries (China and India). I previously wrote about this phenomonen with regards to Foxconn (aka Hon Hai), specifically that Centralized Production is Over. Regionalism is the Future.

To ensure supply and logistics run smoothly, vendors are now forced to store components in multiple locations. Admittedly, each locale may have lower output, but taking into account transport times and the need to keep the cogs moving, we’re likely to see structurally higher component inventories coupled with less flexibility in ramp up or cut back. Yet, as I have also touched on before, this regionalised manufacturing will probably lead to localised products. This was the case during the feature phone era when Nokia and Motorola operated factories across multiple countries and sold devices that were specific to individual markets and regions.1

The iPhone Air was a failure, there’s no denying that. And the cost will be high, though tolerable. For Apple though, the lessons in product development, consumer preferences, and supply chain management maybe end up being more valuable than a dozen truckloads of scrapped components.

Thanks for reading.

More from Culpium:

To be clear, one reason for this regionalism was fragmented mobile phone standards across countries.