How a TSMC Tax Would be a FAFO Move for the US

[Opinion] The US could impose a tax on Taiwanese chips. But it would hurt the very companies Trump used to bolster his tech credentials.

Good Morning from Taipei,

I think it’s highly probable that TSMC Arizona will be spun off due to US government pressure. It would initially be 100% controlled by TSMC, but eventually could get listed on the NYSE or NASDAQ with TSMC HQ’s stake slowly declining. The business model would probably be some kind of technology and management licensing deal because I see no hope for TSMC Arizona doing leading-edge process R&D on its own. But this is way into the future and there’s more pressing issues for TSMC, its clients, and the US government to deal with.

That was me. A month ago. Except, I prefaced it with “Long term.” Perhaps I need to shorten my timeline.

President Donald Trump’s threat to impose a TSMC Tax on Taiwanese semiconductors may be a real thing. Or it may be posturing; the opening salvo in a negotiation to get TSMC to do more in the US. We’ve already seen him use tariffs with that on-again, off-again move against Mexico and Canada, while a moderate increase in duties against China went ahead.

Tariffs Can Work

I’m quite clear in my belief that tariffs are generally bad. Yet, I cannot deny that they have worked in specific instances in the past. For example, Indian Prime Minister Narendra Modi’s Make in India policy — announced a decade ago — included taxing imports to force more domestic electronics assembly. It worked.

But tariffs are only effective when coupled with a solid import-substitution strategy and requisite policy infrastructure. India already had labor and facilities ready to go, so the amount of extra capital investment required to shift from China was moderate.

President Joe Biden put a big chunk of the US policy infrastructure in place with the CHIPS Act, which received broad (but not unanimous) support. So any upside to a TSMC Tax imposed by Trump would be due in large part to his predecessor, and the legislators who passed it.

But that still won’t be enough because, to put it bluntly, the US does not have what it takes to substitute Taiwan-made chips for US-produced alternatives. There’s a few key differences with Make in India that deserve attention. First, India not only has abundant workers, it also has decades of experience and factories in place to assemble smartphones, PCs, and other electronics. Second, it could turn to multiple companies, both domestic and foreign, to build out capacity.

The US only has TSMC. And the American legacy of making leading-edge chips has faded, which is why we are in the situation we’re in now. Let’s not pretend that either Intel or Samsung are anywhere near close to TSMC in terms of leading-edge technology and capacity.

None of this logic will matter if Trump is determined to impose a TSMC Tax, or use the threat of one to stiff-arm TSMC into doing, well, something. Yet, it is important to analyze the situation.

Taiwan Chip Exports to the US are Changing

I dived into the numbers and was quite surprised by what I discovered.

Shipments of raw, stand-alone semiconductors from Taiwan to the US have trebled over the last five years to $10 billion in 2024, according to data from the US International Trade Commission.1 What I didn’t expect was that subsystems, which we sometimes call modules, and partially-assembled systems (classified as those without a keyboard or monitor) have shot up. In particular, the category that includes Graphics Processing Units and Graphics Cards grew at twice the rate of Central Processing Units (CPUs) and other logic chips.

Here’s how I analyzed the data. The Harmonized Tariff Schedule (HTS) categorizes integrated circuits in different ways by delineating GPUs, CPUs, other logic chips, and memory chips. Most helpful, though, is that Nvidia, AMD and Intel publish HTS codes for their products in order to aid compliance with Export Administration Regulations. GPUs are in a whole different category to CPUs because they’re not really “core” chips, they’re largely companion chips which generally require a CPU to function.

But then I had an “ah ha” moment.

Nvidia’s AI GPUs aren’t really sold as GPUs, anyway. If you’ve watched a Jensen keynote anytime in the past two years, you’ll notice he usually holds up a module featuring multiple chips attached to a circuit board. The Grace Blackwell Superchip, for example, is not sold as a chip but as a module.

Normally people wouldn’t care about this minutiae. But when it comes to import tariffs such hair-splitting matters and is an important feature in rulings issued by the US Customs and Board Patrol (CBP) which handles compliance, because tariffs are applied according to HTS code.2

But These Tariffs Won’t Work

Here’s how it could play out. If the TSMC Tax is applied only to actual stand-alone chips, then that would be a modest $10 billion business, compared to the broader $56 billion which includes modules and assembled boards imported from Taiwan to the US last year. Ironically, it would hurt American companies the most because they rely on TSMC to make their best chips, especially those sold as stand-alone.

Intel’s upcoming Ultra Core, for example, is currently in production at TSMC’s N3B node in Taiwan and falls under the stand-alone chip tariff code HTS 8542. If shipped directly to the US, a 100% TSMC Tax would force Intel to double the price from $256 to $512. AMD would cop it worse. It’s 4th-gen EPYC data-center processors are made by TSMC and also fall under the HTS 8542 code. A doubling of the price would take them to more than $20,000 apiece.3 Absorbing this price would be American data center and cloud-service providers.

In such a scenario, Intel and AMD would be left with a simple choice: raise the price to clients or sacrifice margins. Or both. The other option is for their clients to halt or wind back US-manufacturing plans. Foxconn is already expanding its server-manufacturing presence while fellow Taiwanese assemblers Compal and Inventec are also mulling new facilities in Texas. Each of them are doing so to supply American brand name customers like Dell and HP for sale into the US, as well as white-label systems makers who supply major cloud-service providers.

A TSMC Tax Would be a Texas Tax

So a TSMC Tax seems like an own-goal, and would be particularly damaging for Texas which was the largest provider of Electoral College votes for President Trump. It’s also the home state of Senate Committee on Foreign Relations member Ted Cruz, who recently stood up for Taiwan in a squabble with South Africa over Taipei’s diplomatic office. I have no idea how Senator Cruz would view a TSMC Tax, but he’s quite familiar with Taiwan and surely knows the damage such a tariff would inflict on his home state.

If Trump goes further than stand-alone chips and adds import duties to a broader category of semiconductors including GPUs, modules and subsystems then the results could be disastrous. The US bought $22.6 billion of goods in this category last year, and the AI wave means this figure is set to grow for years to come.

Broadening the TSMC Tax would be pointless anyway. Such tariffs wouldn’t even add much extra leverage over TSMC because the extra value-add in these products comes from outside the chip fab.

The US doesn’t have the capacity to manufacture anywhere near a similar volume of equivalent devices. It would take months, if not years, to build the factories, spin up the tools, and then go through the qualification process. And that’s assuming the US has a workforce willing to do the work, especially since the Trump administration is rounding up and scaring away the very talent pool that would likely fill such blue-collar jobs.

Finally, there’s fully or partially-assembled systems which tallied $23.6 billion in 2024. Nvidia’s HGX A100 and DGX A100 systems fall into this category and sell for north of $100,000 apiece. More of this stuff can be done in the US. In fact, Foxconn is doing more and more of this in the US with production of Nvidia’s GB200 expanding in Texas this year, my sources have told me. But if all the previously-mentioned components are hit with a 100% tariff, then the economics of Made in America don’t work. It may be more cost-efficient and expedient to just do the final work in Taiwan or shift more to Mexico or even Vietnam (which has so far escaped Trump’s tariff talk).

Whom a TSMC Tax would hurt most is not its target: TSMC. The company is capacity constrained in advanced-packaging for AI chips and clients have no other choice.

In fact, the biggest victims would be the three men who so proudly and obsequiously fawned over the new president the first full day he was in office: Larry Ellison, Sam Altman, and Masayoshi Son.

Stargate’s $500 Billion Plan is Vaporware. Prove Me Wrong.

Between them they pledged to invest $500 billion over four years into AI infrastructure through a new venture called Stargate. This is number is little more than vaporware. That so many people quoted that figure without question, as if it were gospel, is disappointing. Steer clear.

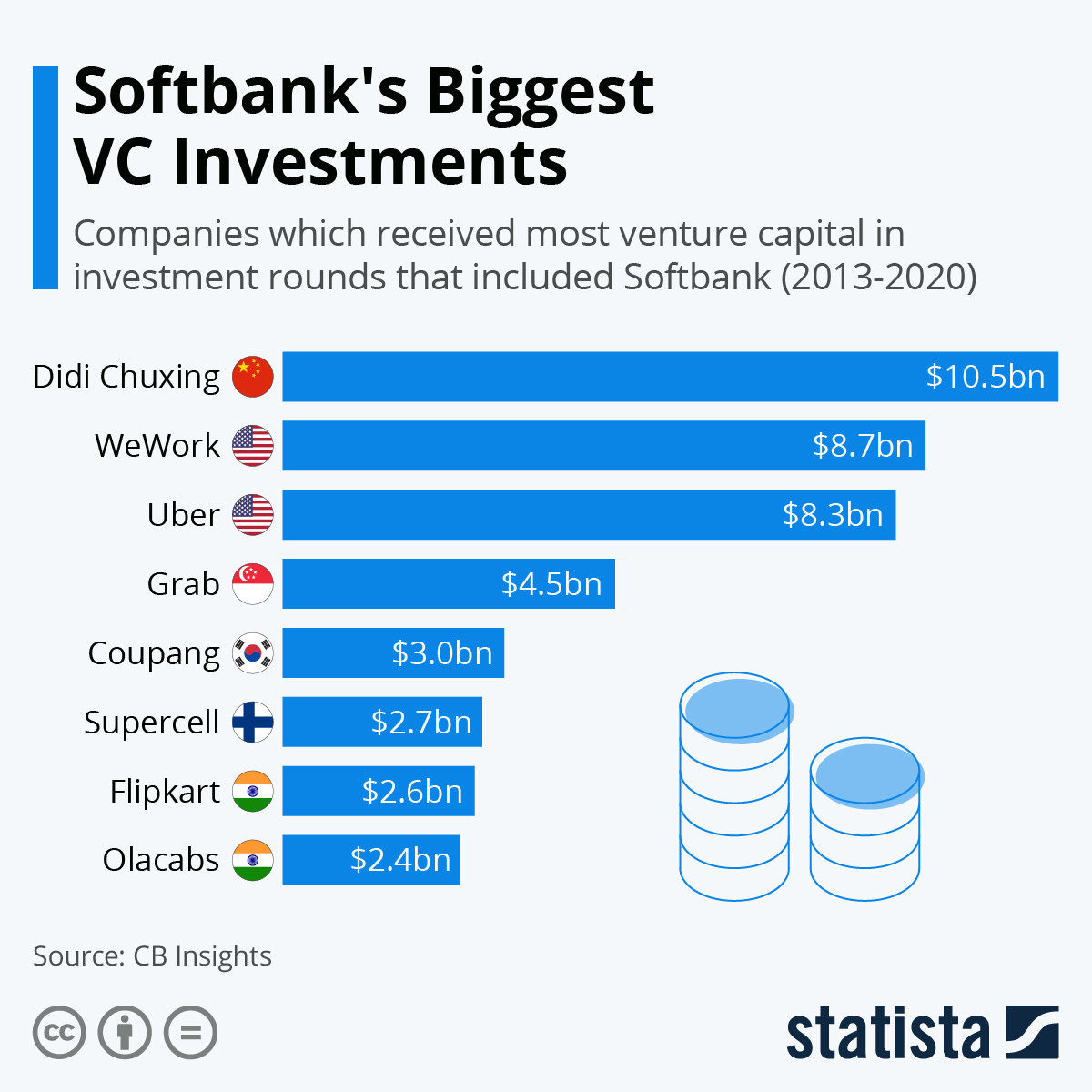

Masa is a fabulist extraordinaire. In December he claimed he’d put up $100 billion into the US to create 100,000 jobs over the next four years. He made a similar pledge when Trump became president the first time, although at half the scale. In reality, two-thirds of the first SoftBank Vision Fund was merely outside money, chiefly from Saudi and UAE governments, whose major impact on the US was to inflate the value of sharing-economy companies like Uber and WeWork. The dollar value and employment figures also didn’t quite reach their target either. By March 2021, after Trump left office, SVF1 and SVF2 had deployed $81 billion, but a large swathe went to non-US startups including Didi Chuxing, Grab, Coupang and Flipkart. It’ll let you Google how those companies, as well as Uber and WeWork, are doing.

In January this year, after proclaiming a month earlier that “I’d really like to celebrate the great victory of President Trump.” Masa took to the stage at the Stargate announcement to claim “we wouldn’t have decided to do this unless you won.” Except, as Ben Thompson at Stratechery quickly spotted, Stargate was announced back in June with Altman and Ellison the driving forces. At the time it wasn’t called Stargate, and Masa wasn’t in the picture, but the project was already underway.

Even without a TSMC Tax, it’s unlikely Stargate would manage to invest $125 billion annually for four years. What it will do is inflate the AI bubble much akin to the undersea cable and internet bubbles of the late 1990s. But whereas the world was left with thousands of miles of useful fiber optic cables, many of the AI data centers Stargate is building will be redundant before the timeline is up. (A boost to electricity infrastructure will be useful, though.)

One reason is the rapid advances in leading-edge semiconductor manufacturing, under the principles of Moore’s Law, which incentivizes players like Nvidia and AMD to keep turning to TSMC for more powerful chips.

The other is that liquid cooling is on the horizon as a vital technology needed to allow these advances to progress because such chips radiate a lot of heat. As yet the industry hasn’t settled on specific standards but liquid immersion, where the whole server rack sits in a bath of non-conductive liquid, seem the most likely solution. This will require rearchitecting the entire design of a data center, including a total rethink of the plumbing and cooling systems.

That means Stargate, and others, will need to not only replace their server trays to keep up with Moore’s Law, but may also need to rebuild entire AI factories.

That said, a TSMC Tax would help Masa, Ellison and Altman hit their $500 billion budget merely through inflation. Of course, that would suck for the poor investors actually footing the bill. That might be UAE and Saudi governments, but one wonders why they’d go through SoftBank when they can just invest directly.

F**K Around, Find Out.

What this all means is that Trump’s plan to slap a 100% tax on Taiwanese chips is really down to a case of Fuck Around and Find Out. Maybe he will, maybe he won’t. I truly don’t know. But if he does, it’ll be a disaster for the US and its plans to stay ahead in the AI race.

What I think Trump really wants is for TSMC to kiss the ring and pledge to invest more in the US.

Coincidentally, TSMC’s board is scheduled to meet in Arizona later this month, the first time it’s done so on US soil. This was planned before the US presidential election, so don’t be too quick to connect the event to Trump’s victory. It’s a nod to the importance of the Arizona project, and that half its board are Americans (and one Brit).

I’ve not been able to glean whether TSMC Chairman and CEO CC Wei will make the trip to DC (or Florida) to meet President Trump. But it would seem like a missed opportunity for the White House to pass up the opportunity. I don’t think Wei would be too eager, though, because he’d probably need to come bearing gifts.

What TSMC Can Offer

That gift would of course be to pledge more investment in the US. My advice to Wei would be to follow Masa’s lead: make the pledge, but be vague and don’t sweat about following through. In fact, don’t worry if you just repeat old plans.

More seriously, I think we could see TSMC tweak its schedule. There’s a growing list of customers lining up to qualify their designs at Arizona’s 5nm/4nm process nodes, whereby the client checks and then signs off on having their products made at the new facility. But there’s a shortage of capacity, so they have to wait for their Made in America chips.

Then there’s 3nm which has already hit its stride in Taiwan, accounting for 26% of revenue last quarter. So instead of waiting for 2nm at Arizona Phase 2, which was to be in conjunction with the rollout of 3nm by 2028, the company could announce they’re bringing forward 3nm. They could then quietly drop 2nm altogether and announce a jump straight to the next one called A16.

With the right finessing, TSMC could dress this up as a serious move to more quickly bring its best technology to the US. Throw in some words about boosting R&D and advanced-packaging (which it’s already doing through a licensing deal with Amkor), and TSMC may do just enough to stave off a TSMC Tax.

Thanks for reading.

This will be my last post for a while.

I will be taking a number of months off to undergo intensive cancer treatment. I may pop up on Notes or socials, and I’ve some ongoing projects that have yet to land which may warrant a post. In the main, though, my mind and body shall be elsewhere. You can share ideas and feedback on my work by replying to this email (if you subscribe). I will not be providing updates on my situation. While I am confident that I have the best care possible from my doctors in Taiwan, nothing in life is certain. I am, however, optimistic for a good outcome. Thanks for your support. See you on the flipside.

Other Items You May Have Missed:

Last year’s data is preliminary and will likely by revised upward.

There can be exceptions to this, including creating special tariffs codes and lumping specific products or classes of products into this category.

There’s numerous SKUs in this range, I just chose one at random.

I was sorry to read of your health condition, Tim. I will remember you in my prayer.Wish you a full recovery.

加油!